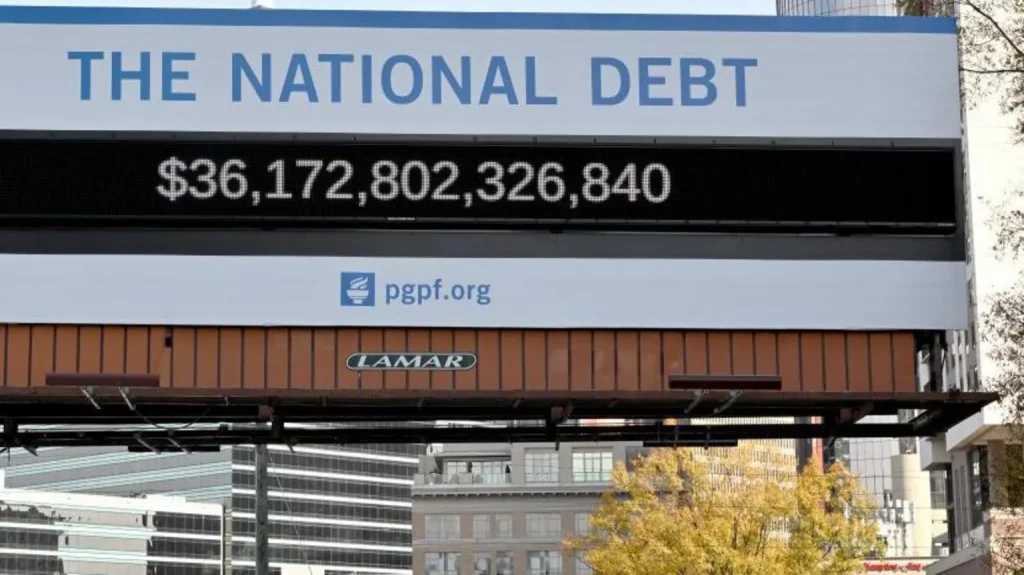

As a potential government shutdown draws near, the U.S. is embroiled in a heated debate over the nation’s debt ceiling. The debt ceiling, which limits the amount the government can borrow to cover its financial obligations, is fast becoming a key point of contention in Washington.

President-elect Donald Trump has called for Congress to raise or suspend the debt ceiling to prevent a default, proposing a plan to fund federal agencies until March 2025 and extend the debt ceiling until 2029. However, the proposal has faced significant opposition from both Democrats and fiscally conservative Republicans, many of whom are demanding that any increase in the debt ceiling be accompanied by reforms to government spending.

The debt ceiling is expected to be hit by mid-June 2025, potentially triggering severe consequences for the U.S. economy. If the ceiling is breached, the U.S. Treasury Department would be unable to issue new bonds, forcing the government to take drastic emergency measures, such as suspending investments into retirement and health benefit funds. A default could lead to economic turmoil, damage the credibility of the U.S. economy, weaken the dollar, and drive borrowing costs higher.

With time running out, lawmakers are under increasing pressure to find a solution that prevents a financial crisis and a potential shutdown.