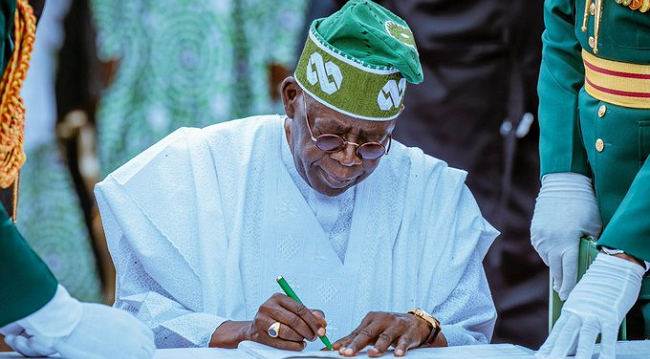

President Bola Ahmed Tinubu of Nigeria has formally requested the National Assembly’s approval for a new external borrowing plan amounting to N1.77 trillion.

The funds, if approved, are expected to partially finance the N9.7 trillion budget deficit in the 2024 fiscal year. This request was presented during Tuesday’s plenary session.

In addition to the loan request, the president submitted the 2025–2027 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) for parliamentary consideration. Tinubu also proposed amendments to the National Social Investment Programme Establishment Act to prioritize the social register as the federal government’s primary tool for implementing social welfare programs.

This development comes against the backdrop of mounting debt servicing obligations. The Central Bank of Nigeria (CBN) recently reported that the federal government spent $3.58 billion on foreign debt servicing in the first nine months of 2024, marking a 39.77% increase compared to $2.56 billion during the same period in 2023.

“The surge in debt servicing costs reflects Nigeria’s growing financial commitments and the adverse impact of exchange rate fluctuations,” the CBN report noted.

State-Level Debt Trends

Similarly, the total debt of Nigeria’s 36 states rose to N11.47 trillion by mid-2024, representing a 14.57% increase from December 2023 figures.

“States remain overly reliant on federally distributable revenue, which exposes them to oil price shocks and other external pressures,” stated BudgIT’s 2024 report.

President Tinubu’s latest request underscores Nigeria’s continuing reliance on borrowing to address fiscal challenges, raising questions about the sustainability of the nation’s financial strategy.