The Federal Government of Nigeria has announced plans to increase the Personal Income Tax (PIT) rate for high-earning Nigerians from 18.6% to 25% as part of its proposed Tax Reform Bills.

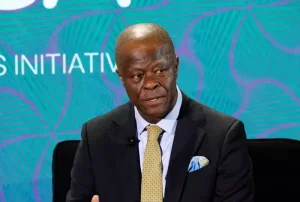

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, revealed this during a Zoom dialogue meeting in Abuja, stating that the tax hike is expected to boost government revenue and accelerate infrastructure development. He highlighted that Nigeria’s economy has experienced relative stability over the past 18 to 20 months, with revenue collection already seeing a 20% increase in the past year.

According to Edun, the tax reforms will also tighten government expenditure and promote economic growth through key sectors such as agriculture, housing, and infrastructure. He emphasized the government’s commitment to enhancing food security by improving both dry and wet season farming techniques.

Additionally, the minister announced the introduction of a 25-year low-interest mortgage scheme with single or low double-digit rates to address the country’s housing deficit. The Highways Management and Development Initiative (HMDI) will also facilitate private-sector involvement in major road infrastructure projects, with the 125-kilometre Benin-Asaba Highway being a prime example of private funding for public road development.

Edun further disclosed that the government is shifting from concessional and bilateral financing to cheaper alternatives, including domestic bond issuance. He reassured pensioners that efforts are underway to resolve outstanding pension debts, with over ₦700 billion already issued in bonds for pension payments.

Acknowledging Nigeria’s reliance on oil revenue, Edun stressed the need to maximize fossil fuel income while encouraging public-private partnerships and privatization to drive investment. He also pointed out that the country narrowly avoided economic collapse at the beginning of the Bola Ahmed Tinubu administration due to excessive reliance on central bank borrowing.

Despite challenges, Edun noted that economic indicators are improving, with inflation slowing down, exchange rate stabilization benefiting imported goods and services, and an overall positive balance of trade. He reiterated the government’s focus on economic stabilization and creating an investor-friendly environment through technology-driven revenue generation strategies.

“With this progress, we are now prioritizing further stabilization and creating a business-friendly environment that encourages private sector participation,” Edun stated.