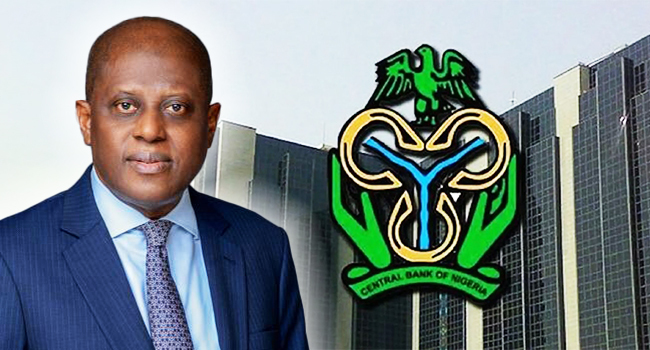

The Central Bank of Nigeria (CBN) has lifted its suspension on banks borrowing from the Standing Lending Facility (SLF), setting the lending rate at 31.75%.

This decision follows the outcomes of the 296th Monetary Policy Committee (MPC) meeting.

Omolara Duke, Director of the Financial Markets Department, announced in a statement dated August 26, 2024, that the MPC adjusted the upper corridor of the standing facilities to 5.00% from 1.00% around the Monetary Policy Rate (MPR). Consequently, authorized dealers are now permitted to access the SLF at 31.75% and can also access the Intra-Day Liquidity Facility (ILF) without cost if repaid the same day, to avoid system gridlock.

However, the CBN retains a 5% penalty for participants who do not settle their ILF, with the system converting the ILF to SLF at 36.75%. Additionally, collateral execution—rediscounting of instruments pledged by participants at the penal rate by CBN—has been reintroduced, as outlined in the approved repo guidelines.

This adjustment aims to streamline the borrowing process for banks and ensure better liquidity management within the financial system.