As an entrepreneur, one of the biggest challenges you will face in starting or growing your business is obtaining funding. Whether you are in the early stages of launching a new startup or looking to expand an existing business, securing the necessary capital can often be a complex and daunting process. However, with the right knowledge, strategy, and mindset, you can navigate the challenges of funding your business successfully. In this article, we will explore key tips and strategies to help entrepreneurs overcome funding obstacles and achieve their business goals.

Understand Your Funding Options:

Before you can secure funding for your business, it’s important to understand the various options available to you. There are several sources of funding that entrepreneurs can explore, including traditional bank loans, angel investors, venture capital firms, crowdfunding platforms, grants, and more. Each funding source has its own requirements, terms, and benefits, so it’s crucial to research and evaluate which option aligns best with your business needs and goals.

Develop a Solid Business Plan:

One of the most important steps in securing funding for your business is to develop a comprehensive and well-thought-out business plan. Your business plan should articulate your vision, mission, target market, competitive analysis, revenue model, financial projections, and growth strategy. A well-crafted business plan not only demonstrates to potential investors that you have a clear direction for your business but also helps you identify the amount of funding required and how you plan to utilize it effectively.

Build a Strong Network:

Networking is essential in the world of entrepreneurship, especially when it comes to funding your business. Building relationships with other entrepreneurs, investors, mentors, and industry experts can open doors to potential funding opportunities and valuable advice. Attend networking events, industry conferences, and pitch competitions to connect with key stakeholders in your industry and raise awareness about your business. Remember, the strength of your network can greatly impact your ability to access funding and grow your business.

Prepare a Compelling Pitch:

When seeking funding for your business, you will often need to pitch your idea to investors or lenders. To make a strong impression, it’s essential to prepare a compelling pitch that clearly communicates the value proposition of your business. Your pitch should succinctly outline your business concept, target market, competitive advantage, revenue potential, and financial needs. Practice your pitch regularly to refine your delivery, answer tough questions, and address investor concerns effectively.

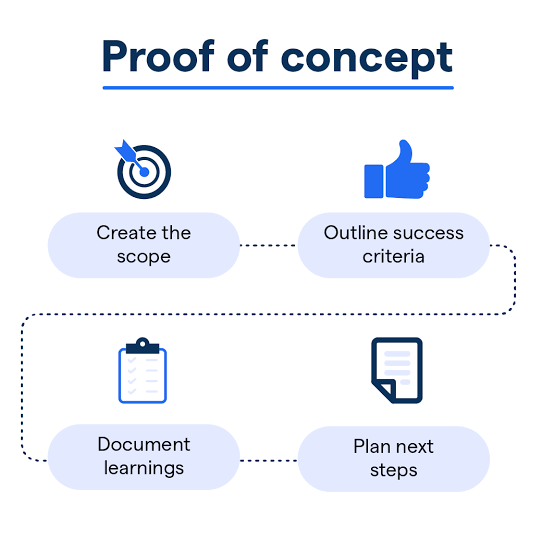

Demonstrate Proof of Concept:

Investors are more likely to fund businesses that have demonstrated proof of concept and traction in the market. Before seeking funding, focus on validating your business idea, acquiring initial customers, generating revenue, and establishing a track record of success. Providing evidence of market demand, customer feedback, and revenue growth will increase your credibility as a business owner and enhance your chances of securing funding.

Consider Bootstrapping:

In some cases, self-funding or bootstrapping your business can be a viable option, especially in the early stages of entrepreneurship. Bootstrapping involves using your own savings, income, or assets to fund your business without external financing. While bootstrapping may require you to be resourceful, frugal, and patient, it can offer you greater control over your business and minimize debt or equity dilution.

Explore Alternative Funding Sources:

In addition to traditional funding options, entrepreneurs can explore alternative sources of capital to fund their businesses. This includes revenue-based financing, peer-to-peer lending, microloans, accelerators, and government programs. Alternative funding sources can offer flexible terms, quick access to capital, and tailored support for startups with unique needs or challenges.

Seek Professional Advice:

Navigating the complex landscape of funding can be overwhelming for many entrepreneurs. Seeking guidance from financial advisors, business consultants, or mentorship programs can provide you with valuable insights, expertise, and support in securing funding for your business. Professionals can help you evaluate your financial needs, structure funding deals, negotiate terms, and avoid common pitfalls in the fundraising process.

Securing funding for your business is a critical milestone in your entrepreneurial journey, but it’s also a challenging and competitive process. By understanding your funding options, developing a solid business plan, building a strong network, preparing a compelling pitch, demonstrating proof of concept, considering bootstrapping, exploring alternative funding sources, and seeking professional advice, you can navigate the challenges of funding your business effectively. Remember, perseverance, resilience, and strategic thinking are key attributes that can help you overcome obstacles, attract investors, and fuel the growth of your business. With the right mindset and support system, you can turn your entrepreneurial vision into a successful reality.

Coach Titilola Aboyade-Cole