The Federal Government of Nigeria has clarified that there is no immediate plan to implement the contentious 5 percent Petroleum Products Tax, which is included in the recently enacted Nigeria Tax Administration Act, 2025.

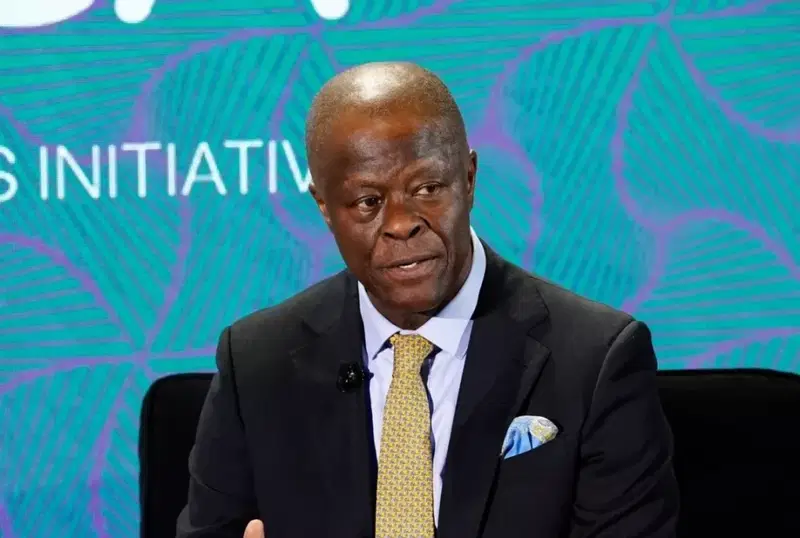

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, addressed the issue during a press conference in Abuja on Tuesday, September 9, 2025, dispelling concerns about an imminent fuel surcharge.

Minister Edun explained that although the 5 percent fuel surcharge is incorporated in the new tax law set to become effective from January 1, 2026, its implementation will not proceed without a formal commencement order. Such an order must be issued by the Honourable Minister of Finance and published in the official government gazette before the tax can be levied.

The minister emphasized that the tax is not a new measure introduced by the current administration but rather a long-standing provision originally included in the 2007 Federal Road Maintenance Agency (FERMA) Act. The surcharge was designed to raise funds dedicated to maintaining and developing Nigeria’s road infrastructure.

Under the original framework, 40 percent of the proceeds from the surcharge would be allocated to FERMA for maintaining federal roads, with the remaining 60 percent going to state road management agencies or their equivalents. The new Tax Administration Act aims to harmonize existing laws and improve transparency and ease of compliance.

The chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, reiterated that there is no fixed date for the surcharge’s commencement, highlighting that revenue collection will only start when the formal gazette order is issued. He noted that the purpose of the surcharge is to fix Nigeria’s deteriorating road infrastructure without placing additional strain on households.

The planned tax has faced strong opposition from labour unions such as the Trade Union Congress (TUC), which has threatened nationwide strikes if the government proceeds with the levy. The TUC argues that the timing is poor, given Nigeria’s high inflation rate and ongoing economic challenges.

Several household energy products like kerosene, cooking gas (LPG), and compressed natural gas (CNG) are exempt from the tax, aligning with Nigeria’s energy transition agenda.

While the 5 percent fuel surcharge is included in the 2025 tax laws, both government officials and tax reform committee leaders confirm that no immediate implementation is planned, and formal steps must precede any tax rollout.