Inflation in the United Kingdom unexpectedly rose to 3% in January, up from 2.5% in December, marking the sharpest increase in ten months. The surge was driven by rising food prices, elevated airfares, and a significant hike in private school fees.

According to the Office for National Statistics (ONS), the cost of essential food items—including meat, eggs, butter, and cereals—has continued to climb, adding financial pressure on households already bracing for higher energy and water bills later this year. Grocery costs saw an average increase of 3.3%, with specific items such as olive oil and lamb witnessing sharp jumps of 17% and 16%, respectively.

Airfares also contributed to the inflationary pressure, as the usual post-holiday price drop was smaller than expected. Additionally, the removal of tax exemptions on private schools led to a 13% surge in tuition fees.

The government has acknowledged that the path to lower inflation will be “bumpy,” while political parties have traded blame. The Conservatives and Liberal Democrats have pointed fingers at Labour’s tax policies, accusing them of exacerbating the situation.

To counter rising costs, the government has introduced an increase in the minimum wage, along with higher benefits and state pensions. However, businesses warn that these measures, combined with rising National Insurance contributions, could lead to further price hikes.

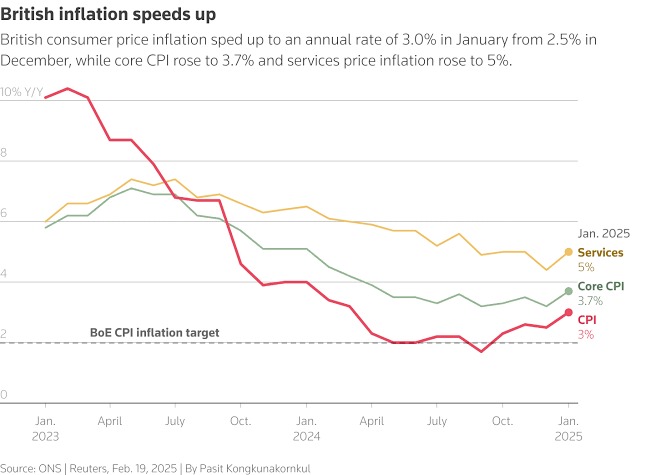

The inflation rate exceeded analysts’ predictions of 2.8%, fueling speculation about the Bank of England’s next move. While inflation had peaked at 11.1% in October 2022, leading the Bank to raise interest rates, the recent easing prompted a rate cut to 4.5%. However, with inflation still above the 2% target, economists suggest the central bank may now proceed with caution in future rate cuts.

Professor Jonathan Haskel, a former member of the Bank of England’s Monetary Policy Committee, told the BBC that policymakers could either dismiss the inflation spike as temporary or take it as a sign of more persistent inflationary pressures.

Grant Fitzner, ONS chief economist, attributed January’s inflation jump partly to the VAT charge on private schools, calling it a “one-off” factor. However, financial experts warn that rising wage costs for supermarkets and producers could lead to further food price increases in the coming months.

Sarah Coles, head of personal finance at Hargreaves Lansdown, noted that additional price hikes are expected in April, when energy, water, and council tax bills are set to rise. “This is why it has become known as ‘Awful April,’” she said.

Despite government assurances, concerns remain that persistent inflation could further strain household budgets and delay the Bank of England’s plans for further interest rate cuts.