The Nigerian National Petroleum Company Limited (NNPCL) announced another increase in the price of Premium Motor Spirit (PMS), commonly known as petrol, raising the cost to N1,025 per litre in Lagos and surrounding areas, up from N998. In Abuja, the price jumped to N1,060 per litre, compared to the previous N1,030. This marks the third price increase within a 60-day period.

Despite the recent drop in the price of Nigeria’s Bonny Light crude, which declined from $75 to $72 per barrel, NNPCL proceeded with the price hike, attributing the adjustment to the ongoing deregulation policy that allows market forces to determine fuel costs. The crude price decrease indicates an 8.2 percent shortfall from the 2024 budget benchmark of $77.96 per barrel, intensifying the challenges faced by the economy.

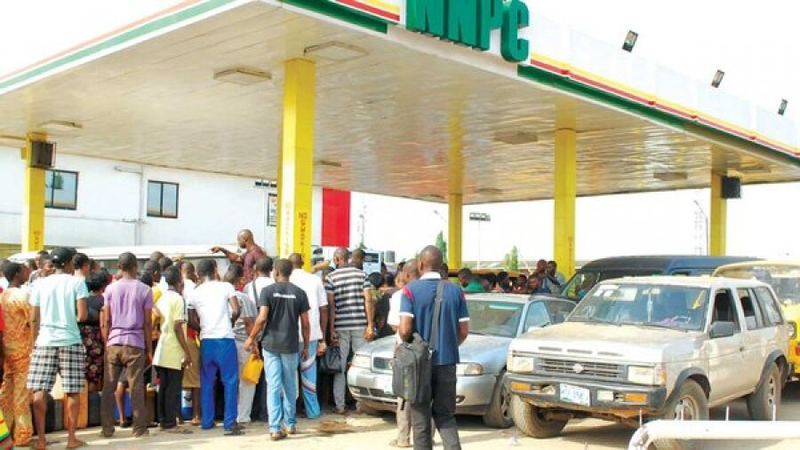

In Lagos, filling stations swiftly updated their prices in line with the new directive, while long lines of motorists rushed to outlets that had yet to implement the new rates. In Abuja, major marketers reportedly shut their gates Tuesday evening to recalibrate their meters to reflect the increase. However, Ardova Plc, an independent marketer opposite the NNPC Retail mega station, continued selling at the previous rate of N1,125 per litre, offering temporary relief for motorists.

The current price spike follows an earlier adjustment by NNPCL this month, which saw prices rise from N897 to N1,030 per litre. The deregulation policy, implemented by the Federal Government, removes subsidies and ties pump prices directly to global market conditions and currency value. However, the naira’s continued depreciation, now at N1,664 to the dollar, has further driven up fuel costs.

When asked for comment, NNPCL spokesperson Olufemi Soneye was unavailable, but sources within the industry confirmed the latest hike reflects the dynamics of demand and supply. “This is the third adjustment made in September and October based on deregulation. The policy allows for price changes driven by market forces, and the naira’s weakness is also a contributing factor,” stated an industry insider who requested anonymity.

With fuel prices climbing at an unprecedented pace, Nigerians face increased financial pressures across transportation, goods, and services, raising public concerns over the economic impact of ongoing deregulation.